Last Updated Jan 08, 2026

The Math on Customer Retention: Why a 5% Increase = 25-95% More Profit

You’ve probably heard the statistic: increase customer retention by just 5%, and profits jump 25-95%.

It sounds too good to be true. A tiny improvement creating massive returns? But the research behind this claim is solid—and understanding why it works can transform how you think about growing your business.

Here’s what three decades of research actually shows, and more importantly, what you can do about it.

Where the Famous Statistic Comes From

The 5%/25-95% figure traces back to Frederick Reichheld of Bain & Company and Harvard Business School professor W. Earl Sasser Jr. Their 1990 Harvard Business Review article, “Zero Defections: Quality Comes to Services,” analyzed customer retention economics across multiple industries.[1]

The original claim was actually bolder: “Companies can boost profits by almost 100% by retaining just 5% more of their customers.”[2]

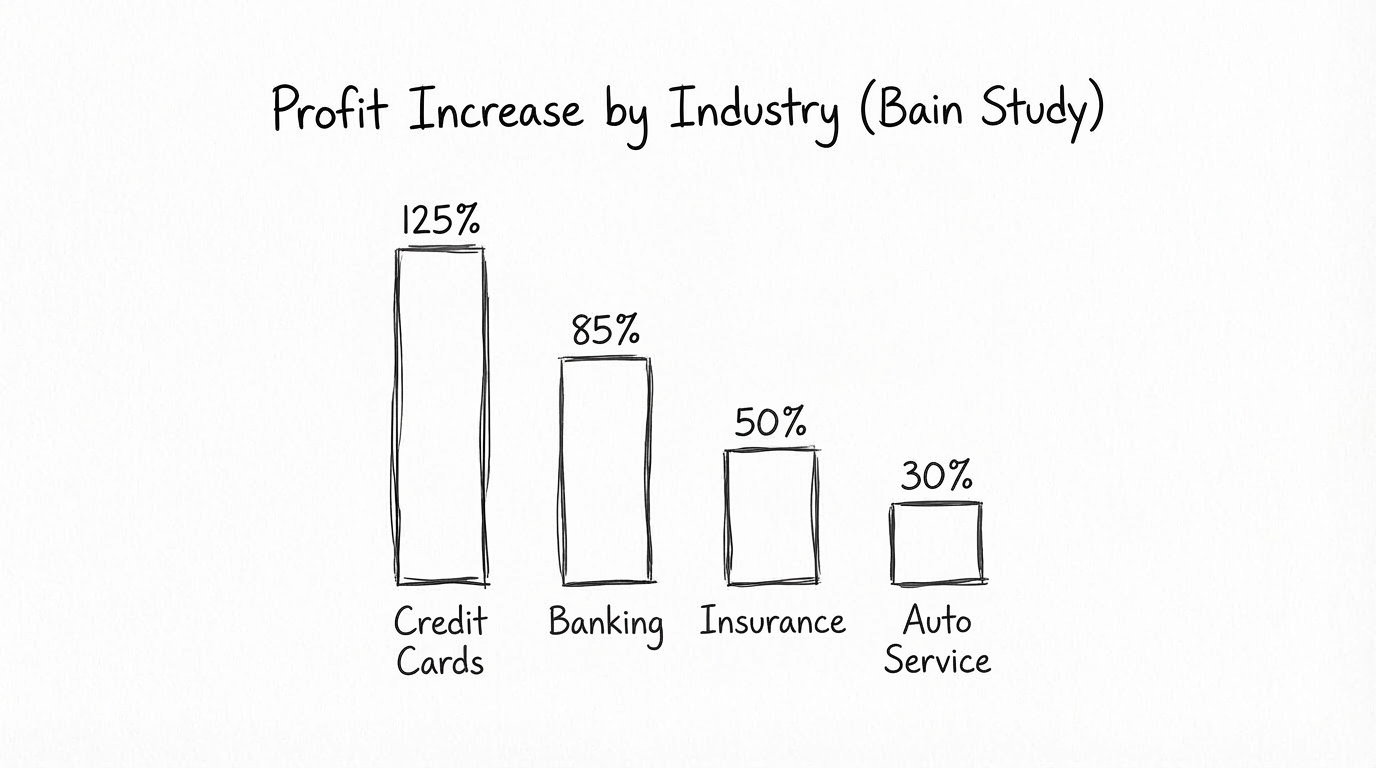

The specific numbers varied dramatically by industry. Credit card company MBNA saw 125% profit increases. Banking showed 85%. Auto service came in at 30%.[3] The commonly cited “25-95%” range emerged later as a summary across all the industries studied.[4]

The math works because of compounding effects. Retained customers:

- Cost nothing to acquire (you already paid for them)

- Spend more over time (31-67% more after the first year)[5]

- Refer new customers (saving you acquisition costs)

- Require less hand-holding (they know how you work)

- Are less price-sensitive (they trust your value)

Each factor compounds the others. A customer who stays 5 years isn’t just worth 5x a one-year customer—they’re worth far more.

The Acquisition Trap

Most businesses are stuck in what we call the acquisition trap: spending 80% of marketing budgets chasing new customers while existing ones quietly slip away.

The economics don’t support this approach. Acquiring a new customer costs 5-25x more than retaining an existing one.[6][7] For a local service business, that might mean spending $150 in advertising to acquire a customer you could have kept with a $5 text message.

The probability math is even more stark. Existing customers have a 60-70% likelihood of buying again. New prospects? Just 5-20%.[8]

Think about your own business. How many past customers haven’t come back—not because they were unhappy, but because they simply forgot about you? That’s not a marketing problem. That’s a retention problem.

Why Satisfied Customers Still Leave

Here’s where the research gets uncomfortable.

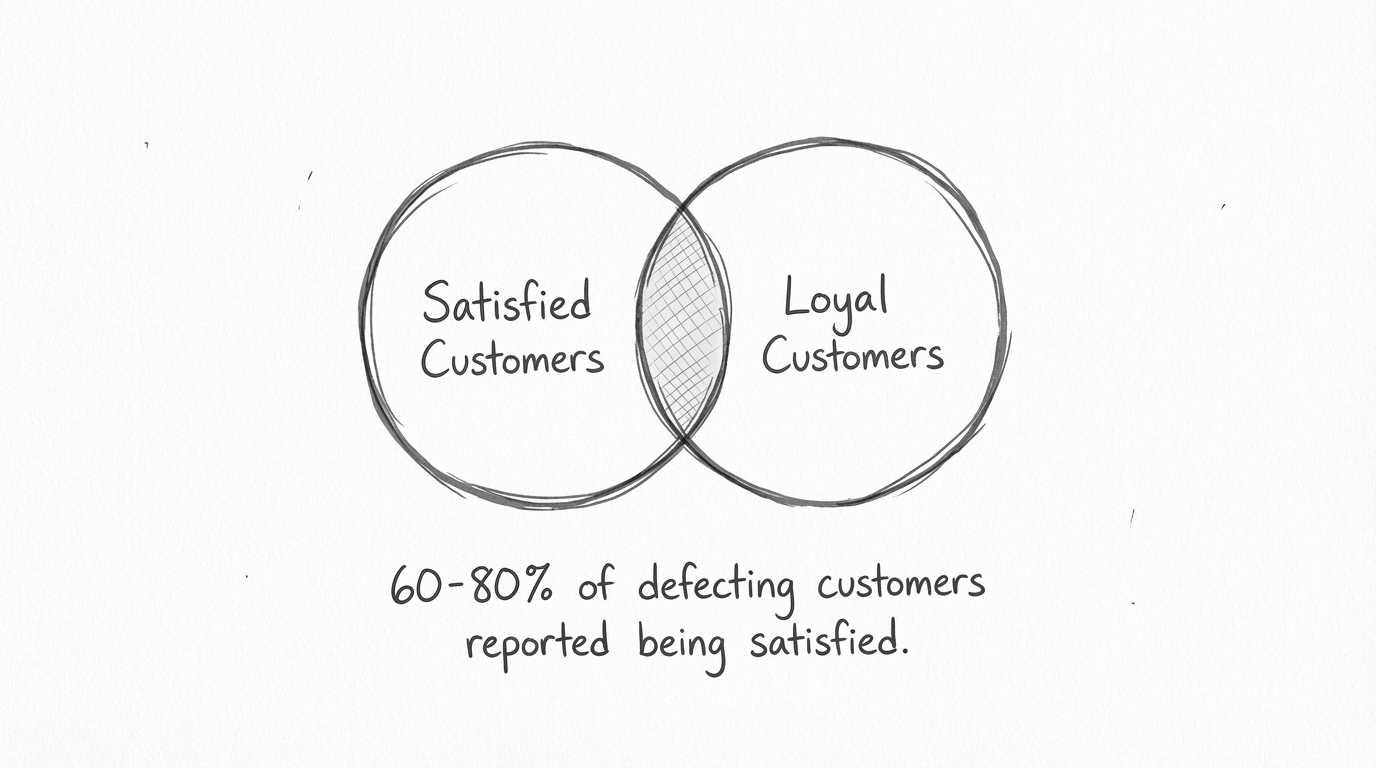

Reichheld’s follow-up studies found that 60-80% of customers who defected had reported being “satisfied” or “very satisfied” right before leaving.[9] A landmark study of 75,000 customer interactions found that 20% of satisfied customers intended to leave, while 28% of dissatisfied customers planned to stay.[10]

Customer satisfaction and customer retention are not the same thing.

Satisfaction measures whether you met expectations. Retention measures whether staying with you is easier than switching to someone else. These are fundamentally different questions.

This explains why reducing customer effort matters more than delighting customers. Research shows customer effort is 40% more accurate at predicting loyalty than satisfaction.[11] When interactions are frictionless, 94% of low-effort customers repurchase. When they’re difficult, just 4% return.[11]

The implication? Stop trying to exceed expectations. Start removing friction.

The Silent Churner Problem

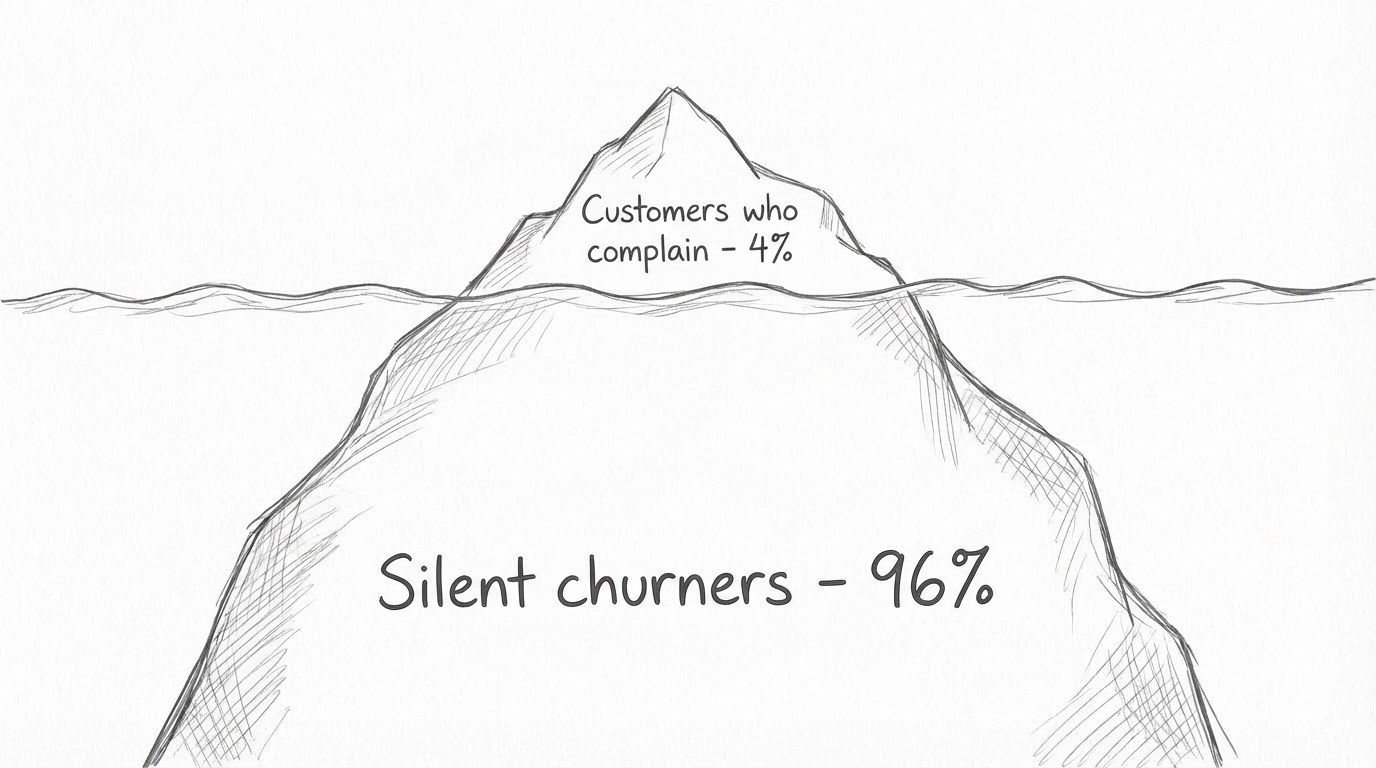

Only 1 in 26 unhappy customers actually complains.[12] The rest just leave without saying anything.

If you’re waiting for negative feedback to identify problems, you’re only seeing 4% of the picture. The other 96% are voting with their feet—and you’ll never know why.

The top reasons customers leave are preventable:[13]

- Poor customer service (68% cite this as their reason for leaving)[12]

- Feeling unappreciated (customers who feel valued stay longer)

- Being lured by competitors (often with offers you could have matched)

- Ineffective onboarding (23% of churn happens here)[13]

Notice what’s not on this list: price. While price increases can trigger churn, most customers leave for reasons that cost nothing to fix—they just needed someone to reach out.

What Actually Works: Evidence-Based Retention Tactics

Enough theory. Here’s what the research shows actually moves the needle.

1. Automated Appointment Reminders

This is the highest-impact intervention for appointment-based businesses. A systematic review of 29 studies found reminders reduce no-shows by an average of 34%.[14]

Dental practices report 35-50% reductions.[15] Healthcare sees 30-45%.[16] Salons and wellness businesses achieve 40-60% decreases.[17]

SMS outperforms other channels with a 1.90% no-show rate versus 2.68% for email and 3.49% for phone calls.

The financial impact is real: one study of 1.6 million appointments found that reducing no-shows by 22.95% increased practice revenue by $31,457.

2. Simple Loyalty Programs

Loyalty program members who redeem rewards show 3.1x higher annual spend than non-redeemers.[18] Business owners report an average ROI of 4.8x from loyalty programs, generating 5.2x more revenue than they cost.[19]

For small businesses, complexity kills. A salon offering $10 off every 5th haircut ensures $200 in retained business before the reward is redeemed. A home services company offering priority scheduling for repeat customers creates switching costs without spending a dollar.

3. Personalization That Matters

Companies excelling at personalization generate 40% more revenue than average performers.[20] The bar has risen: 71% of customers now expect personalization, and 76% feel frustrated when they don’t receive it.[20]

For service businesses, personalization doesn’t require AI algorithms. It means:

- Remembering their name and preferences

- Referencing their last visit (“How’s that shoulder doing?”)

- Anticipating their needs (“You’re probably due for another appointment”)

When your CRM integrates with your phone system, this information is available before you even say hello.

4. Win-Back Campaigns for Lapsed Customers

Re-activating former customers costs 5x less than acquiring new ones.[21] Re-engagement campaigns typically achieve 10-30% reactivation rates,[22] with optimal timing at 21-45 days after last interaction.

The key is reaching out before they’ve moved on emotionally. A “we miss you” message at 30 days feels personal. At 6 months, it feels like spam.

5. First-Contact Resolution

Every 1% improvement in first-call resolution correlates with a 1% improvement in customer satisfaction and 1% reduction in operating costs.[23][24]

The inverse is devastating: 69% of customers will switch providers after a poor service experience.[25][11] Customers are 4x more likely to leave an interaction feeling disloyal than loyal.

This is why phone answering matters. When customers call with a problem and reach voicemail, you’ve already failed the first-contact test.

The Psychology Behind Loyalty

Understanding why these tactics work helps you apply them correctly.

Loss aversion makes customers value what they have more than equivalent gains. This is why loyalty points, accumulated status, and “you’ll lose your streak” messaging works—the psychological pain of losing is roughly 2x the pleasure of an equivalent gain.[26]

Status quo bias keeps customers with existing providers even when alternatives exist. Research shows 70% of B2B customers prefer maintaining current arrangements.[27] Every interaction that builds familiarity strengthens this bias.

The peak-end rule explains why specific moments matter more than average quality. People judge experiences primarily by the emotional peak and the ending—not by duration or overall quality. This means a strong ending (a thank-you text, a follow-up call) can transform an average experience into a memorable one.

Trust mediates everything. In healthcare, patient satisfaction alone has no direct relationship with loyalty—trust is the mediating factor.[28] The same applies across industries: customers don’t stay because they’re satisfied. They stay because they trust you.

The Service Recovery Paradox

Here’s a counterintuitive finding: customers who experience a problem that gets resolved well can become more loyal than customers who never had a problem at all.[29]

This is the service recovery paradox. When you fix something quickly and fairly, you demonstrate commitment that normal transactions never reveal.

The window is narrow—you have to catch problems fast and resolve them completely. But it means mistakes aren’t necessarily fatal. What matters is what you do next.

Making It Practical: A Retention Priority List

Based on the research, here’s what to focus on first:

-

Reduce friction before increasing delight. Make every interaction as effortless as possible. Answer phones quickly. Make rebooking easy. Remove unnecessary steps.

-

Automate the follow-up you’re not doing. Appointment reminders, post-service check-ins, rebooking prompts. The automation isn’t about replacing human connection—it’s about ensuring connection happens at all.

-

Watch behavior, not surveys. Track who’s coming back less frequently, who’s spending less, who used to call and stopped. These signals predict churn better than any satisfaction survey.

-

Reach out before they leave. A customer who hasn’t visited in 60 days is at risk. A customer who hasn’t visited in 6 months is probably gone. Timing matters.

-

Fix service failures fast. The recovery paradox only works if you catch problems quickly. Build systems that flag issues before customers have to complain.

The Bottom Line

The 5%/25-95% statistic is real, but it’s not magic. The profit increase comes from specific, measurable improvements: fewer no-shows, more rebooking, higher customer lifetime value, lower acquisition costs, and more referrals.

Every business leaks customers. The question is whether you’re measuring the leak—and plugging it.

The good news? Most of your competitors aren’t doing this well. In a world where 62% of small business calls go unanswered and most follow-up never happens, simply being present and consistent is a competitive advantage.

Your best customers are the ones you already have. The math says so.

Sources

- Reichheld, F. & Sasser, W.E. (1990). "Zero Defections: Quality Comes to Services." Harvard Business Review. Bain & Company ↩

- Reichheld, F. Original research cited in PubMed. ↩

- "The Importance of Retention Rate." Maxwell Investments Group. ↩

- Reichheld, F. (1996). The Loyalty Effect: The Hidden Force Behind Growth, Profits, and Lasting Value. Harvard Business School Press. ↩

- "Statistics Show Repeat Customers Spend More and More Often." Conversational LLC. ↩

- "Boosting Proven Customer Retention." Number Analytics. ↩

- "Why Customer Retention Costs 5x Less Than Acquisition." Post Affiliate Pro. ↩

- "Pricing for Customer Acquisition vs Retention." Getmonetizely. ↩

- Harvard Business Review on Increasing Customer Loyalty. Everand. ↩

- Dixon, M., Freeman, K., & Toman, N. "Stop Trying to Delight Your Customers." Harvard Business Review. The Effortless Experience. ↩

- "Customer Satisfaction Stats." SurveySparrow. ↩

- "Customer Loyalty Statistics." SAP Emarsys. ↩

- "Three Leading Causes of Churn." Retently. ↩

- "Reminder Systems and No-Shows: A Systematic Review." PubMed Central. ↩

- "Dental Automated Appointment Reminders." Inshalytics. ↩

- "Patient Appointment Reminder Statistics." Dialog Health. ↩

- "How Automated Reminders Reduce No-Shows." Prospyrmed. ↩

- "Loyalty Program Statistics." Queue-it. ↩

- "The Secret to Calculating Loyalty Program ROI." Antavo. ↩

- "The Value of Getting Personalization Right—or Wrong—Is Multiplying." McKinsey & Company. ↩

- "What Is Customer Win-Back Rate in E-commerce?" Alexander Jarvis. ↩

- "Guide to Customer Win-Back Programs." Dotdigital. ↩

- "First Call Resolution." Atlassian. ↩

- "First Call Resolution Statistics." GetVoIP. ↩

- "Customer Retention Statistics." ServiceNow. ↩

- "How Does Loss Aversion Affect Your Pricing Strategy?" Getmonetizely. ↩

- "The Role of Personalization in Customer Retention." Socialtargeter. ↩

- "Trust as a Mediator Between Patient Satisfaction and Loyalty." PubMed Central. ↩

- "The Service Recovery Paradox." Retently. ↩

Stop the Leak

Ready to keep more of the customers you've already won?

Tiny Tortilla's Marketing Automation and Re-engagement solutions help you stay connected with customers automatically—rebooking reminders, win-back campaigns, and follow-up sequences that run while you focus on your work.

Book a Consultation →